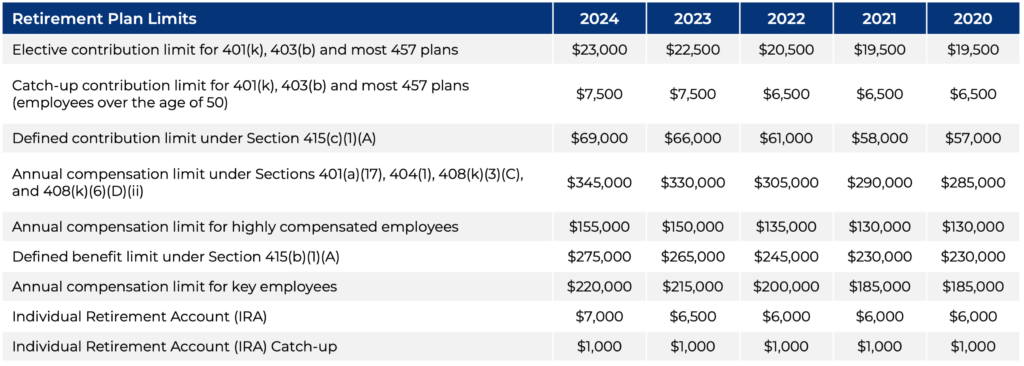

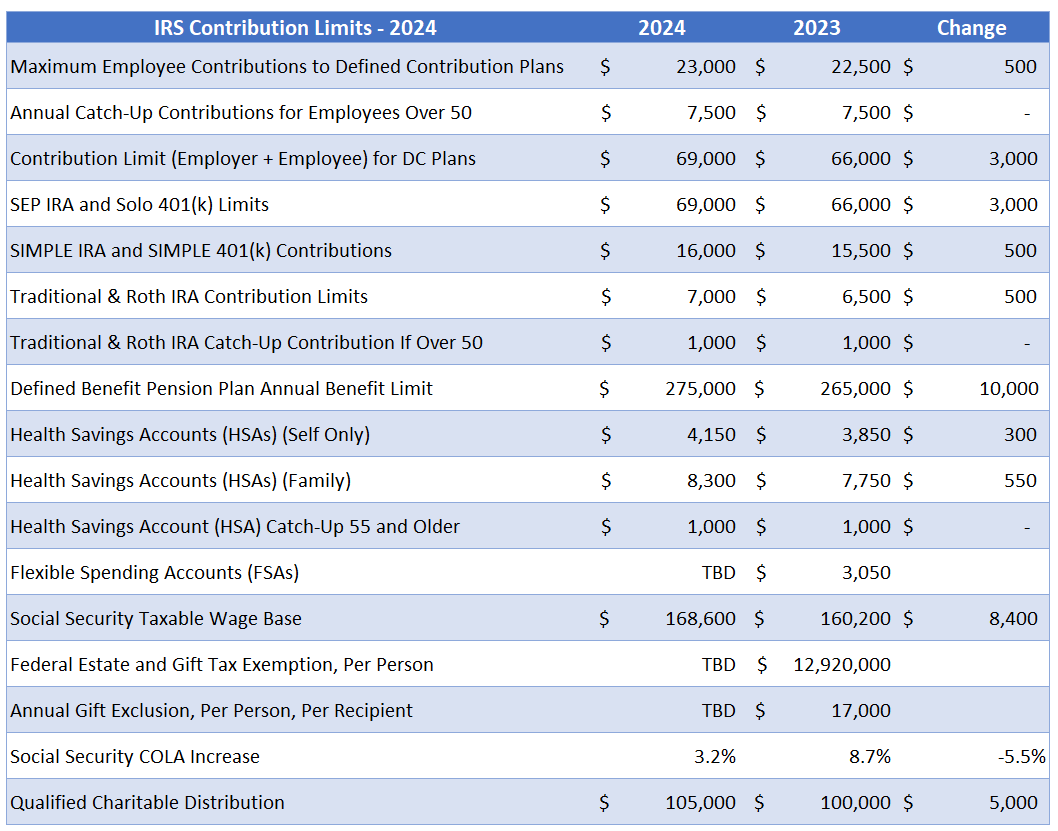

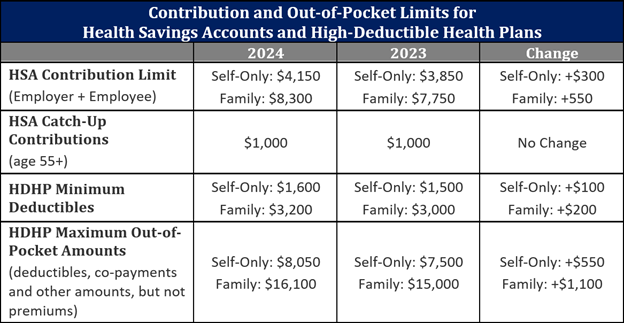

Irs Plan Limits For 2024 – The parameters of this government largesse change annually. For 2024, the IRS only allows you to save a total of $7,000 across all your traditional and Roth IRAs, combined. This figure is up from the . Participating in a 401(k) through your employer can be a good way to contribute to and save for your retirement. One important thing to know is that there are limits on how much you can contribute .

Irs Plan Limits For 2024

Source : www.captrust.comThe IRS Has Increased Contribution Limits for 2024 — Human Investing

Source : www.humaninvesting.comNew 2024 IRS Retirement Plan Contribution Limits [Including 401(k

Source : www.whitecoatinvestor.comContribution Limits Increase for Tax Year 2024 For Traditional

Source : directedira.com2024 IRS 401k IRA Contribution Limits | Darrow Wealth Management

Source : darrowwealthmanagement.comNew 2024 IRS Retirement Plan Contribution Limits [Including 401(k

Source : www.whitecoatinvestor.comThe IRS Announces New 401(k) Plan Limits for 2024 – Sequoia

Source : www.sequoia.comIRS Unveils Increased 2024 IRA Contribution Limits

Source : www.theentrustgroup.comIRS Announces HSA and HDHP Limits for 2024

Source : www.keenan.comIRS announces retirement plan contribution limits for 2024 | E

Source : enews.wvu.eduIrs Plan Limits For 2024 IRS Announces 2024 Retirement Plan Limitations | Retirement Plans : And for the 2024 tax year, the IRS has announced that these limits will jump for six different types of retirement accounts — five types of workplace plans plus IRAs. Additionally, income limits . According to the IRS, 20% of eligible taxpayers don’t know about the Earned Income Tax Credit, yet it could add thousands of dollars in tax savings back into their pockets. .

]]>